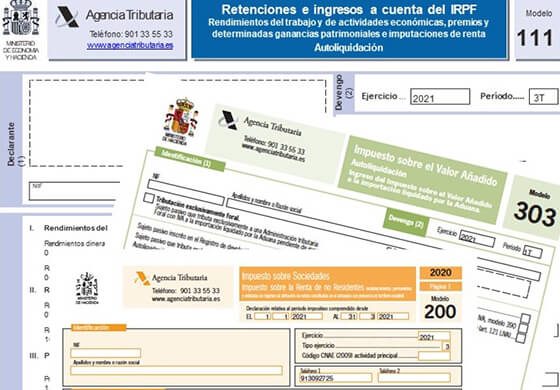

Seguridad y experiencia en su Asesoría fiscal, es nuestro pan de cada día. Ofrecemos tranquilidad y legalidad en sus impuestos. Contacte con nosotros.

Esta web utiliza cookies para que podamos ofrecerte la mejor experiencia de usuario posible. La información de las cookies se almacena en tu navegador y realiza funciones tales como reconocerte cuando vuelves a nuestra web o ayudar a nuestro equipo a comprender qué secciones de la web encuentras más interesantes y útiles.